What is leverage in forex trading?

For example, within brokerage margin accounts, a 2:1 ratio is often used, explains Brian Stivers, an investment advisor and founder of Stivers Financial Services. Mezzanine Financing Structure Source: Prudential Financial. Some leverage trading strategies, particularly options, have potentially infinite risk. It is often easy or complex, depending upon the nature of the problem. We’ve just gone over several types of leverage ratios, primarily financial, operational, and consumer. Uniformed Riz Guard 11 episode, 2021. The company’s leverage is therefore very high. Required fields are marked.

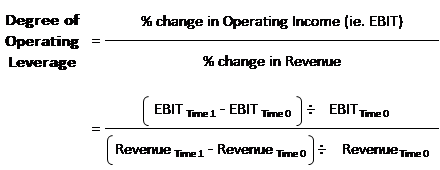

Operating Leverage Formula: How to Calculate It with the Income Statement

Banking regulations for leverage ratios are complicated. Such residents and countries include, but are not limited to, the United States. Instead of being limited to only the $5 million from investors, the company now has five times the amount to use for the company’s growth. All finance and quotes are subject to status and income. The mechanical advantage or power gained by using a lever. 3rd season no commercials. Managers have to keep track of operating leverage ratios to recalibrate the company’s pricing structure as necessary to achieve more sales, considering a tiny drop in sales can easily cause profits to dive. When using leverage, you need to apply tested trading strategies and risk management rules to protect your capital. Based on the historical data from the trailing two periods of our hypothetical company, there is $1. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. However, it should be clarified that every broker has its own scale of values for this indicator. Access and download collection of free Templates to help power your productivity and performance. ” With summer and fall professional learning in mind, explore these resources. 3%, which is an equivalent of 1:30 leverage for major forex pairs. It can help investors to maximise returns on even small price changes, to grow their capital exponentially, and increase their exposure to their desired markets. Ultimately, this means that the business will be able to expand its profit margin more quickly.

Subscribe to our newsletter

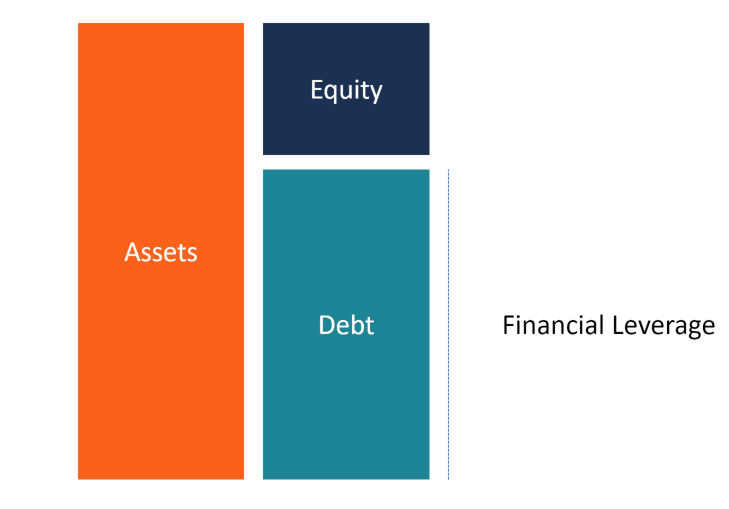

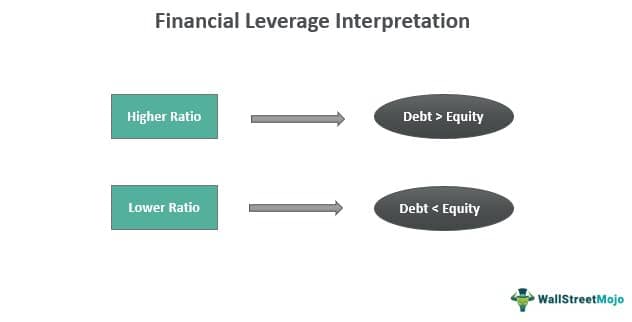

” Remember, they and Hardison were working together in the years between series. On the one hand, taking out a loan allows for a greater investment, which can increase the return on investment and raise the business’s equity and profit. Technically speaking, margin simply refers to the amount of capital a trader has within their trading account. Before the 1980s, regulators typically imposed judgmental capital requirements, a bank was supposed to be “adequately capitalized,” but these were not objective rules. Arbitrage is the process of simultaneous buying and selling of an asset from different platforms, exchanges or locations to cash in on the price difference usually small in percentage terms. Leverage is created through various situations. As mentioned above, one company’s leverage ratios being higher than another’s doesn’t mean much if the two companies are in different industries, especially if one has been around for a lot longer than the other. For example, let’s say you want to buy a house. Business owners love Patriot’s award winning payroll software. The capital and leverage requirements for domestic systemically important banks are supplemented by the requirements described in OSFI’s Total Loss Absorbing Capacity TLAC Guideline. That said, some events – such as market gaps – can put your entire balance at risk. The assessment of a good operating leverage ratio depends on the nature of the industry and the company’s specific circumstances. Announcements can be found in our blog. To view or https://trade12reviewblog.com/ add a comment, sign in. After reading the margin account agreement, select ‘I understand’. Financial Leverage refers to the borrowing of capital by a corporation from lenders, such as banks, to fund its operations and long term investments in fixed assets PPandE. Therefore, operating risk rises with an increase in the fixed to variable costs proportion. Click here to use the Body Solid online Room Planner program. The formula for calculating the contribution margin is: contribution margin = sales revenue variable costs. A high equity multiplier indicates that a company is using a large amount of debt to finance assets while a low equity multiplier signals a lower reliance on debt. If all goes well, you’ll repay your borrowed funds quickly and snag investment returns in the process. This has to do with operating leverage. Moonfare aims to lead a new era of private equity investing by creating the opportunity for higher returns for more people. An alternative approach is to measure financial risk using cash flow leverage ratios, which help determine if a company’s debt burden is manageable given its fundamentals i. Management Educator: Courses, Cases and Teaching eJournal. For our examples let’s assume that after one year, the land owned by Mary and the land owned by Sue increased in value by 20% and both Mary and Sue sold their land investments at the market values. KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary Stock Broker, DP, Mutual Fund, etc.

‘Leverage: Redemption’ Sets ‘Angel’ Reunion With James Marsters Guest Starring

Consequently, a contribution that is new from our study is that researchers can develop theoretical expectations of financial advantages for social enterprises like CBCs even though their focus is not on value capture. 9 More recent data from the September 2023 SCOOS suggested that the use of financial leverage by hedge funds remained largely unchanged between mid May 2023 and mid August 2023 figure 3. Increase in EBIT of Company A = DOL × % Change in Sales = 1. That’s the number of terms in our glossary. Leveraged trading in foreign currency contracts or other off exchange products on margin carries a high level of risk and may not be suitable for everyone. All Worldwide Rights Reserved. Fixed costs that are financial costs such as interest expense create financial leverage. Call 0800 195 3100 or email newaccounts. When teachers provide explicit instruction, they make clear for students how to engage in a particular skill, how to be strategic when they approach a task such as solving a mathematics problem or summarizing a paragraph, or how to define a concept using examples and nonexamples. WHY BUSINESS OWNERS LOVE FRESHBOOKS. Interest Coverage Ratio = Operating Income/Interest Expenses. “This means you use less of your own personal money. The equity multiplier would be. The first method is exchanging cryptocurrency through an exchange. Financial leverage is the use of borrowed capital to fund investment in assets or projects. Trader Y prefers higher risk and opens a 5 lots position, effectively using leverage of 50:1. For example, comparing the operating leverage of Apple to GM is not a fair comparison, but comparing Apple to Microsoft is a more reasonable comparison. With a brokerage, however, there is no “other person” you come and exchange your crypto coins or fiat money with the platform in question, without the interference of any third party. Sway: Being the only industry in town gave the company considerable leverage in its union negotiations.

Related Links:

Your ratio can give you an indication of how your business finances assets and operations. Financial leverage is the use of borrowed capital to fund investment in assets or projects. 2, this scenario relies on a generalized contraction of the major economies. Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland. With a reasonable ratio, you can deal in amounts that initially seemed unattainable. Leveraged trading can be risky as losses may exceed your initial outlay, but there are numerous risk management tools that can be used to reduce your potential loss, including. Then, one new episode will be released weekly until the season finale on Wednesday, Jan. ” we need to understand that there are several different types of LBOs that each fit a different scenario. We can see the real power of leverage by jumping into the future. An increase in revenue will result in a larger increase in operating profit. The more money a company borrows, the more leveraged it becomes. Numerous financial and other organizations are currently experimenting with the use of blockchain technology to save money on transactions by improving payment processing. If you used margin, you’d earn $4,000 or 40% of the cash you invested. Increase in EBIT of Company B = 1. 50 billion and a total capital drop to $13 billion. The equity multiplier formula is. Furthermore, you will have to pay back the broker the $100 debt plus interest. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. National Association of State Directors of Special Education NASDSE. By loaning money from the bank, you’re essentially using leverage to buy an asset — which in this case, is a house. Our editorial team does not receive direct compensation from our advertisers. The Total Debt to Total Assets Ratio is a financial metric that helps to understand how many degrees of a company’s assets are funded by debt. So what is leveraged trading. The “other” category consists of other asset backed securities ABS backed by credit card debt, student loans, equipment, floor plans, and miscellaneous receivables; resecuritized real estate mortgage investment conduit Re REMIC RMBS; and Re REMIC CMBS. At the end of 2007, Lehman had $738 billion of notional derivatives in addition to the assets above, plus significant off balance sheet exposures to special purpose entities, structured investment vehicles and conduits, plus various lending commitments, contractual payments and contingent obligations. The degree of operating leverage can depict the impact of operating leverage on the firm’s or the company’s earnings before interest and taxes EBIT.

The unseen players of Economy

In monetary administration, leverage isn’t vastly different; it implies an adjustment of one component, bringing about an adjustment of benefit. The New Dictionary of Cultural Literacy, Third Edition Published by Houghton Mifflin Harcourt Publishing Company. It’s the total amount of money you have in your trading account. Libby Barnes 1 Episode. For example, physical retail stores are in the decline phase of the cycle with the rise of internet retail. He is a board member of the Fiver Children’s Foundatoin, a non profit organization that helps New York City youth. The higher the leverage ratio, the higher the risk for both the lender and the borrower because if the lender has to take the property over, they have less downward margin from what the value of the property is to what they have to sell it for to recoup their principal loan balance. Therefore the stress testing analysis may be considered as a risk integration forerunner, as shown below. Billy Barnes 1 Episode. Armortech 3 Tier Dumbbell Storage Rack. It’s widely used in the corporate world as well. The result is a calculation of future project returns. To calculate it, take the EBIT earnings before interest and taxes and divide it by the interest expense of long term debt. DFL=EBITEBIT−interestDFL = frac EBIT EBIT text interest DFL=EBIT−interestEBIT. This limits accounting leverage. After doing some analysis, both of them agree that USD/JPY is hitting a top and should fall in value. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On that basis, Lehman held $373 billion of “net assets” and a “net leverage ratio” of 16. The worst case scenario is that your startup’s debt obligations exceed its assets. Of these ratios, perhaps the most important are financial leverage ratios. This means that it uses more fixed assets to support its core business.

Click here to see the full list of USA TV Premiere Dates

Using leverage also allows you to access more expensive investment options that you wouldn’t otherwise have access to with a small amount of upfront capital. By clicking Continue, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. But when the journalist is grabbed, our team has to infiltrate a London Ball to extract him. Times interest earned TIE, also known as a fixed charge coverage ratio, is a variation of the interest coverage ratio. 7B in Green Bonds Support Innovative Green Technology. Paris, France, an affiliate of GoCardless Ltd company registration number 834 422 180, R. Exinity Capital East Africa Ltd with registration number PVT ZQU6JE7 and registration address at West End Towers, Waiyaki Way, 6th Floor , P. 35 for debts, like loans and other liabilities. This weekly update is designed to help you stay informed and relate economic and company. Operating margins are the basis of determining the profitability of companies. It’s built on the idea of spending money to make money. The degree of financial leverage can be negative for abscess. Reviewed by Axel Rudolph, Senior Market Analyst. They usually then augment the platform company with a stream of add on acquisitions to expand regionally, product wise, and customer segment wise. After one year, the value on our fictional facilities rise by 10%. Everything you need to master financial and valuation modeling: 3 Statement Modeling, DCF, Comps, MandA and LBO. Using leverage allows you to maximise the use of your capital, as you can maintain a smaller cash balance in your trading account while still gaining access to larger positions, which frees up funds for other opportunities. It’s built on the idea of spending money to make money. You can contact us at: or. Financial leverage is an important concept to understand when trading in the financial markets. Relax—run payroll in just 3 easy steps. Debt to Capitalization Ratio = Short term Debt + Long term Debt/Short term Debt + Long term Debt+ Shareholder Equity. Leverage magnifies both gains and losses. For example, in the UK business loans allow you to claim interest repayments as a tax deduction. We have processes in place to ensure the security of your personal information. THE CERTIFICATION NAMES ARE THE TRADEMARKS OF THEIR RESPECTIVE OWNERS. This regulatory treatment has the benefit of avoiding inconsistencies from netting which may arise across different accounting regimes.

James Marsters

To test Hypothesis 1, we measure sales growth as the total sales in year t divided by the total sales in year t 1 e. However, a high DOL can be bad if a company is expecting a decrease in sales, as it will lead to a corresponding decrease in operating income. The common types of leverage trading include margin trading, leveraged tokens, and futures contracts. If a company borrows money to modernize, add to its product line or expand internationally, the extra trading profit from the additional diversification might more than offset the additional risk from leverage. The formula to calculate the Degree of Financial Leverage is as below. By hiring salespeople and enhancing marketing, a company can convert more of its costs from fixed to variable using financial leverage. Algorithm trading is a system of trading which facilitates transaction decision making in the financial markets using advanced mathematical tools. Browns QB Joe Flacco’s honest feelings on not getting call from Jets. Conversely, the degree of operating leverage would be reduced when there is a high proportion of variable costs to fixed costs, since in this case most costs must be incurred every time a unit is produced. The actual number will be slightly different because we rounded the factor from 3. You have AU$10,000 in your trading account. The final line item to deduct from pre tax income before reaching net income is taxes, which we’ll assume is equal to zero for the sake of isolating the impact of leverage. Suggest a new Definition. Paris, France, an affiliate of GoCardless Ltd company registration number 834 422 180, R. The effective cost of debt is lower than equity since debt holders are always paid out before equity holders; hence, it’s lower risk. Securing funding is a tall order for any business. You are putting down a fraction of the full value of your trade – and your provider is loaning you the rest. Using market values for calculating leverage ratios provides a more accurate representation of the company’s financial position.

Hawn Tran

From the perspective of corporations, there are two sources of capital available. Warehouse closed through Dec 26th. For instance, 90% and 95% percentage losses require percentage gains of 900% and 1900% to recover respectively. The strategy can be applied across various markets including Forex, indices, stocks, commodities and ETFs. Your pitch deck should include important financial information about the business to help investors understand whether it’s a good investment. Our webinars, workshops and how to videos can help you learn the basics of leverage trading for free. Leverage ratios are essentially measures of risk, since a borrower that cannot pay back its debt obligations is at considerable risk of entering bankruptcy protection. Trading 212 Markets Ltd.

“My Demon” and “The Story of Park’s Marriage Contract” Score Decent Ratings

2019 that constitutes a financial disadvantage compared to non certified and common commercial firms. Financial leverage leans into the idea that borrowing cash to cover a new investment has the potential to pay off in the long run. Too much debt is damaging to any company’s finances. DOL=QP−VQP−V−Fwhere:Q=quantity produced or soldV=variable cost per unitP=sales priceF=fixed operating costsbegin aligned andtext DOL = frac text Q text P text V text Q text P text V text F andtextbf where: andtext Q = text quantity produced or sold andtext V = text variable cost per unit andtext P = text sales price andtext F = text fixed operating costs end aligned DOL=QP−V−FQP−Vwhere:Q=quantity produced or soldV=variable cost per unitP=sales priceF=fixed operating costs. Debt to Equity Ratio = Total Debt ÷ Total Equity. The classic LBO consists of the acquisition of a company by an investor with leverage. Find out everything you need to know. The core objective of a corporation is to maximize shareholder wealth, per financial management theory. BT, CA, CF, CT, DD, DG, DH, DN12, DN14 DN15, DN18 DN19, DN26, DN36 DN39, DN41, DL, DT, EH, EX, FK, FY, G, HG, HU, IV, KA, KW, KY, LA, LD, LL, ML, NE, PA, PH, PL, PR, SA, SR ,SY16 SY20, SY23, SY25, TA, TD, TQ, TR , TS, YO. In Teaching with Digital Technologies, interns learn how to lead a whole group discussion in a blended or virtual learning environment. 4 is considered good, so in this case the trucking company would be in good financial shape to borrow more. Accessible Version Return to text. 9% and economic capital expected shortfall at the 99. Competition: Firms that operate in a highly competitive environment may need to take more leverage to contend with their peers. Both Trader A and Trader B have a trading capital of US$10,000, and they trade with a broker that requires a 1% margin deposit. A FitchSolutions Company. Spending most of his time watching new movies at the theater or classics on TCM, some of Michael’s favorite movies include Casablanca, Moulin Rouge. Debt to capital ratio = Debt / Debt + Equity. If you don’t have a Risk. This is an example of using financial leverage—John is using borrowed money to try to increase his profits. This perception is incorrect. Flight Attendant1 episode, 2022. Efiling Income Tax ReturnsITR is made easy with Clear platform. 66 $400 million ÷ $150 million.

Park Shin Hye and Park Hyung Sik Excel as Exemplary Students in “Doctor Slump”

Mailchimp® is a registered trademark of The Rocket Science Group. For illustration, let’s say a software company has invested $10 million into development and marketing for its latest application program, which sells for $45 per copy. It works by turning to debt, which allows the user to invest more capital than they have thanks to the capital that they have borrowed. Companies or firms with a large or huge proportion of the fixed costs to the variable costs will have higher operating leverage levels. The value of an investment may go down as well as up. Operating leverage is one of the more important considerations when analyzing a company, but it is one of the more underutilized ideas. When asked whether there was any news on the revival, the response from TVLine was as follows: “I checked in on its renewal status just before the holiday, and it’s still , sorry. Roughly a third of liquidity in investment grade CDS comes from skew activity. Powerlessness’ refers to the state of being defenseless, without power, and lacking any might or strength. Electric also acquires, distributes and sells worldwide rights to Electric’s produced and acquired content, as well as theatrical films from around the world, including Blood On The Crown, starring Harvey Keitel and Malcolm McDowell, Heavy, starring Sophie Turner and Daniel Zovatto, Rob Reiner’s historical biopic LBJ, starring Woody Harrelson, and Book Of Love, starring Jessica Biel and Jason Sudeikis. Oh, my gosh, it’s actually happening.

Products

Neither the negative relation between leverage and sales growth nor the positive relation between leverage and employment costs for CCFs extend to CBCs. There are various leverage ratios and each of them are calculated in different ways. It’s anything that could be sold for money. Judge Kerry Durham uncredited 1 Episode. When this is done on a larger scale, private firms buy many companies at once in an attempt to diversify their risk among various industries. Many businesses rely on the ability to borrow money for a portion of their capital, helping them continue to run their businesses. Whether you’re trading margin or perpetual contracts, leverage can turn into a dangerous game. How Do Companies Create Leverage. It’s never a good idea to have too much debt in business nor will those investing in such a business look favourably upon such a notion for obvious reasons. In simple terms, you could win more or you could lose more by using financial leverage. Financial leverage allows businesses to make investments that provide an alternative to issuing shares or raising equity capital. Where total debt = Short Term and Long Term Borrowings, Debentures and Bonds. Well, these words are generally very much pertaining to whatever is covered in the target page. The unusually large swings in profits caused by a large amount of leverage increase the volatility of a company’s stock price. What is hedging and how does it work. With this measurement, you can better evaluate how financially stable a company is, and use this metric to compare other companies within the same industry. • Delivery is to front door, ground level only. However, leverage is a great tool only when you are confident that the likelihood of a profit is higher than the likelihood of a loss. Lloyd Van Winkle 1 Episode. For short term self liquidating trade letters of credit arising from the movement of goods e. The fact is that the leverage ratio’s key strength is also its weakness. This means that your monthly interest payments are typically lower than they are in periods of high interest rates. The swap removes most of the economic risk of the treasury bond, so economic leverage is near zero. Below are some examples that show how leverage works.